od claim investigation

SpyBot Verifacts offers AI-powered identity verification tools that can help validate customer information and prevent identity theft or misrepresentation.

motor own damage claims investigations

We have a specialized team to do in-depth investigations into bogus motor or vehicle insurance claims for our clients.

Fraud detection using AI for car damage assessment | Image/video analysis using AI for fraud detection has become feasible after the recent major improvements in computer vision technology. Learn more about how AI can help detect and prevent car inspection fraud.

Fraud Detection Using Mobile App AI – Preventing Vehicle Inspection Fraud

The introduction of modern technology like Artificial Intelligence and the digitalization of fraud detection processes is a giant step forward in preventing auto inspection fraud.

SpyBot Verifacts, for example, has been helping insurance and mobility companies detect and prevent motor insurance fraud with an AI-enabled platform. The platform delivers multiple features such as video-based auto damage detection, detection of old or prior damages, identifying damage cover-ups with stickers, fraud detection through metadata, etc. While the following modules are specific to SpyBot Verifacts, this is how AI can help detect and prevent car inspection fraud:

Vehicle Damage Inspection – Our patent-pending technology specializes in damage detection on various vehicles such as cars etc.

Our product has been trained on 7 MN+ damage asset photos/videos

which allows us to achieve a very high level of accuracy (96%+)

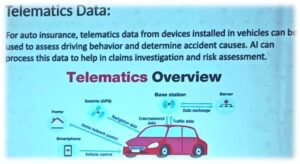

Telematics is a tracking technology that uses the principles of telecommunication and informatics.

A telematics system stores and transmits driving-related data. It has three main components:

Telematics Control Unit, Cloud Server, Mobile Interface, OBD Based, App-Based, Black-Box Based.

NCB Concealed: These usually comprise fraud committed at policy inception to save premiums. This involves intentionally concealing the information

or not providing correct details on the proposal form. For example, while switching from one insurer to another, if a customer does not disclose details

of a claim made previously and attempts to avail of NCB (No Claim Bonus) discounts, it is considered fraud.

Number plate replacement: There are instances where the uninsured vehicle meets with an accident causing loss to the owner. However, the policy is availed after the loss of a vehicle of similar make and model by replacing the number plate.

Fake Documents: Fake document fraud at the underwriting stage may also arise when the insured submits fabricated documents or false information to avail of a policy. For example fabricated policy from previous insurers and fake reports in collusion with third parties.

Fake License: There have been many incidents where the insured produces a fake driving license while making a claim. The insured gives in to this practice in case his license has expired which could result in repudiation of the claim,

Driver Swapping: In this case while intimating a claim the insured provides wrong information on the person who was driving the vehicle at the time of the accident

Staged accidents/thefts: Many times claimants stage thefts or accidents to avail claim. Occasionally, although the insured vehicle does not suffer any accidental loss/damage, the loss is claimed by fabricating the accident and damage.

Claims Padding: It is also referred to as “legalized fraud”, this means increasing the damages to a vehicle to overstate the claim. This is usually done in collusion with motor dealers or repair garages.

Multiple Claims: Motor insurance is generally an exclusive contract. If the insured takes multiple policies for the same vehicle and makes multiple claims for the vehicle for the same damage amounts to fraud.

Misrepresentation of facts: The claimant misrepresents the facts while claiming an otherwise genuine loss like changing the spot of the accident and the cause of loss.

False Claims: Often false claims of bodily injuries are made due to an accident. False reports and fake documents are presented in collusion with the police, transport, and other officials.

Motor Salvage Frauds- Frauds observed in the Motor Salvage for Total Loss or Constructive Total Loss Claims, where the value of a Wreck/Damaged vehicle is undervalued by the group of Internal Employees, Intermediaters, and Buyers. This may cause huge salvage revenue loss to the company under the Subrogation right of insurers

Cover note Frauds: These are amongst the most prevalent types of motor insurance frauds which involve issuing of backdated cover notes on already damaged vehicles. Cover note frauds also entail the issuance of cover notes changing the details of the vehicles to give undue benefit to the customer or utilizing expired cover notes to issue policy,

Low Market Value Vehicles with Insured for Higher Value (IDV) claimed for Total Loss through Staged Accident / Fire Loss or Staged Theft Loss.

Policy arranged for non-insured accidental vehicles and claimed in the policy period.

Modus of Operandi:

Low Market Value Vehicles with Higher Insured Value (IDV) claimed for Total Loss through Staged Accident /Fire Loss or Staged Theft Loss

Reference from: https://timesofindia.indiatimes.com/city/delhi/man-files-online-reports-of-fake-car-thefts-for-insurance-caught/articleshow/100833626.cms

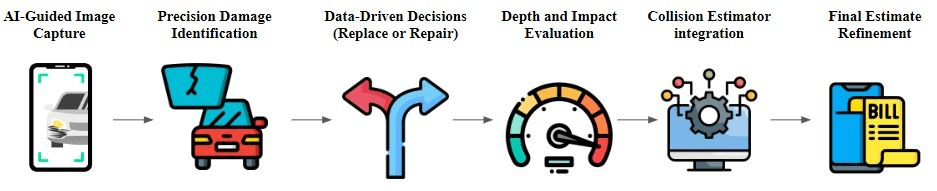

Revolutionizing Vehicle Claims Repair with AI-Powered Precision

In the auto aftermarket, precise vehicle damage assessment is crucial, especially with advancing vehicle technology. Traditional methods are outdated, and unable to identify complex damages like those involving ADAS and electronic components. Enter AI – revolutionizing accuracy and efficiency in damage assessment, propelling professionals to the industry’s forefront.

At SpyBot Verifacts, we’re redefining vehicle repair estimates by harnessing the power of AI alongside expert technician skills. Here’s how:

AI-Guided Image Capture: Our AI directs technicians to capture comprehensive vehicle damage images, ensuring meticulous documentation and assessment.

Precision Damage Identification: AI accurately identifies and classifies vehicle damages from images, capturing minor details previously overlooked.

Data-Driven Repair Decisions: AI assesses damage severity and cost implications, streamlining repair strategies and enhancing driver safety.

Depth and Impact Evaluation: AI evaluates damage depth and impact, facilitating accurate repair plans and cost estimation.

Integration with collision estimator: AI insights merge seamlessly with collision estimator workflows, establishing new standards of accuracy and efficiency.

Final Estimate Refinement: AI refines preliminary estimates, delivering detailed final estimates to guide insurers and repairers toward optimal decisions.

Join us in shaping the future of automotive repair with AI precision and expertise.